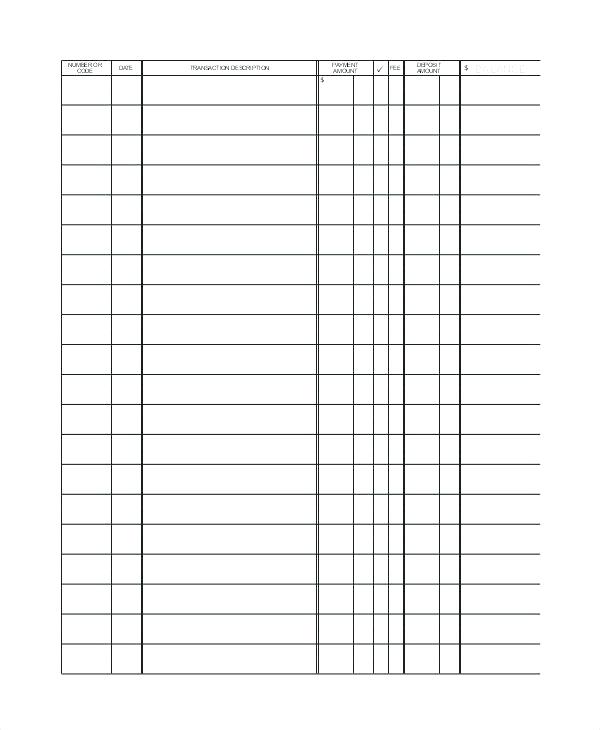

- PERSONAL CHECKBOOK REGISTER FULL

- PERSONAL CHECKBOOK REGISTER LICENSE

- PERSONAL CHECKBOOK REGISTER PLUS

- PERSONAL CHECKBOOK REGISTER FREE

We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.ģ Out-of-network ATM withdrawal fees apply except at MoneyPass ATMs in a 7-Eleven location or any Allpoint or Visa Plus Alliance ATM. See Terms and Conditions.Ģ Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. Your limit may change at any time, at Chime's discretion. You will receive notice of any changes to your limit. Your limit will be displayed to you within the Chime mobile app. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Chime was the 2021 #1 most downloaded banking app in the US according to Apptopia ®.ġ Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. #1 Most Loved Banking App Source: Chime received the highest 2021 Net Promoter Score among competitors in the industry according to Qualtrics ®. We recommend you review the privacy statements of those third party websites, as Chime is not responsible for those third parties' privacy or security practices. The privacy practices of those third parties may differ from those of Chime.

PERSONAL CHECKBOOK REGISTER FULL

See your issuing bank’s Deposit Account Agreement for full Chime Checkbook details.īy clicking on some of the links above, you will leave the Chime website and be directed to a third-party website. While Chime doesn’t issue personal checkbooks to write checks, Chime Checkbook gives you the freedom to send checks to anyone, anytime, from anywhere.

Please see back of your Card for its issuing bank. and may be used everywhere Visa credit cards are accepted.

PERSONAL CHECKBOOK REGISTER LICENSE

The Chime Visa® Credit Builder Card is issued by Stride Bank pursuant to a license from Visa U.S.A. and may be used everywhere Visa debit cards are accepted. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Indeed, it is better than before where you'd sit down once a month to make sure all your deposits and withdrawals lined up.Banking services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC.

Moreover, most transactions are now instantaneous.

Today, there are plenty of checkbook apps to balance your checkbook and keep your finances updated so you can instantly review your deposits and payments. This is due to the advent of online commerce and technology. But nowadays, keeping track of financial accounts is a lot easier.

PERSONAL CHECKBOOK REGISTER FREE

Why? Because you had to document every transaction in the free checkbook register to keep an accurate running balance. It is also considered a cash disbursement journal, as it records all the checks, outlays of the cash, and cash payments during an accounting period.Īccording to an article from Health Care Family, balancing a checkbook before was critical since there is no online account history to check. This checkbook is a booklet or a folder containing pre-printed paper instruments, which bank holders use to withdraw money from their checking account deposits. Checks are documented to what we call “checkbooks”. It wasn't until the early 1500s in Holland wherein checks first got widespread usage. Did you know experts believed the Romans invented checks in about 352 B.C? But the idea didn't catch on.

0 kommentar(er)

0 kommentar(er)